Borrowers are eligible to have their loans forgiven.

How Much?

A borrower is eligible for loan forgiveness equal to the amount the borrower spent on the following items during the 8-week period beginning on the date of the origination of the loan:

• Payroll costs (using the same definition of payroll costs used to determine loan eligibility)

• Interest on the mortgage obligation incurred in the ordinary course of business

• Rent on a leasing agreement

• Payments on utilities (electricity, gas, water, transportation, telephone, or internet)

• For borrowers with tipped employees, additional wages paid to those employees

The loan forgiveness cannot exceed the principal.

How could the forgiveness be reduced?

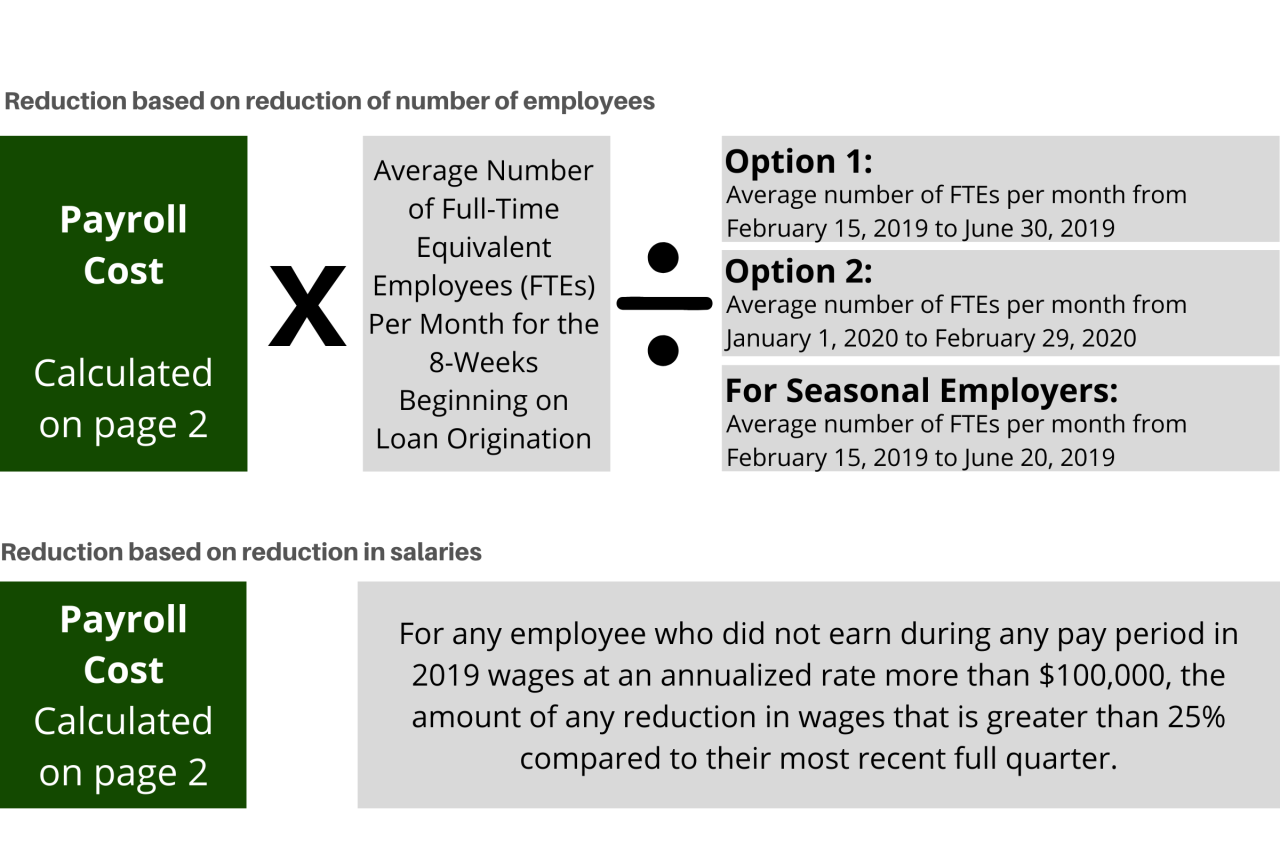

The amount of loan forgiveness calculated above is reduced if there is a reduction in the number of employees or a reduction of greater than 25% in wages paid to employees. Specifically:

What if I bring back employees or restore wages?

Reductions in employment or wages that occur during the period beginning on February 15, 2020, and ending 30 days after enactment of the CARES Act, (as compared to February 15, 2020) shall not reduce the amount of loan forgiveness IF by June 30, 2020, the borrower eliminates the reduction in employees or reduction in wages.